I'm going to be closely documenting my

journey from in debt to financial freedom in this blog post. Let's

just say that my debt is in the high 5 figure mark and this is going

to be my way of keeping accountability to myself, goals, family, and

to you reading this post.

I'm going to share money saving and

marketing tips. I know being in debt (90K+) what would I know about

saving money right? Well you can learn how to stretch a dollar a

long way and you may pick up a few money saving ideas as well as

learn how to create some extra income in your life.

I hit bottom a couple times and keep on

getting back up. I now do internet marketing for a couple of clients

to the tune of $1080 per month and have got my personal online

business up to around $150-200 per week.

So, am roughly bringing in around $400

per week. I'm going to be brutally honest as that will also be a

part of this blog. When I start summer school in a couple months,

the GI bill will also give me an extra $800-$1900 per month.

The real goal is to show you how you

can create extra money in your life by saving money (from my own hard headed experience) and starting a home

business (again learn from my hard headed mistakes).

My online system is something I call 4

corners and 4 streams. These are 4 separate programs that all work

together that aren't dependent on each other.

Four Corners Alliance Group

This is the primary business and the

product is financial education. Results not typical.

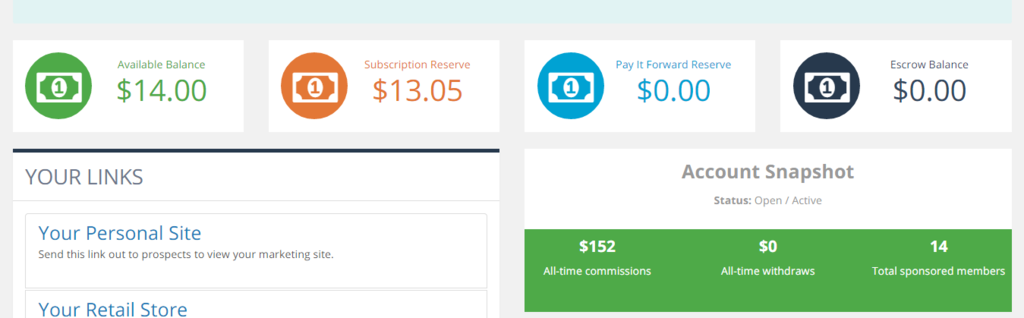

Power Lead System

This is the glue and the marketing

system that allows me to share the plan. Am getting anywhere from

$20-40 per week every Wednesday. Results not typical.

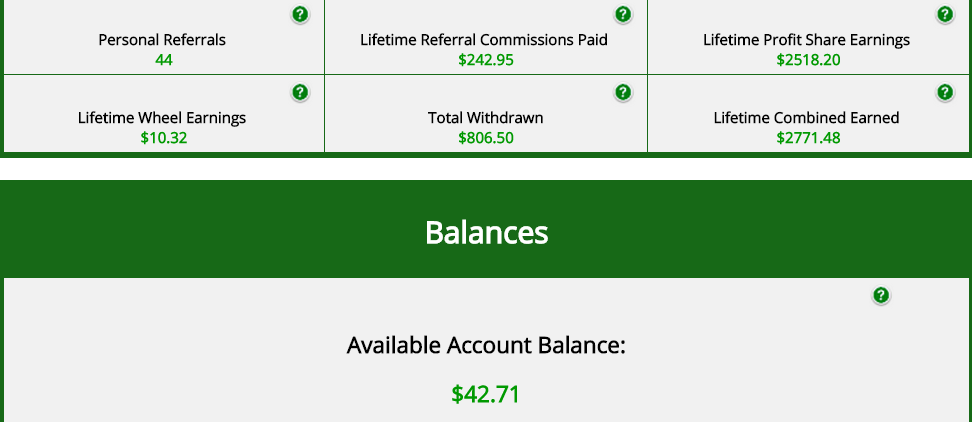

Traffic Monsoon

This is a traffic and revenue sharing

program that allows me to get paid hourly even when no one joins me.

Results not typical.

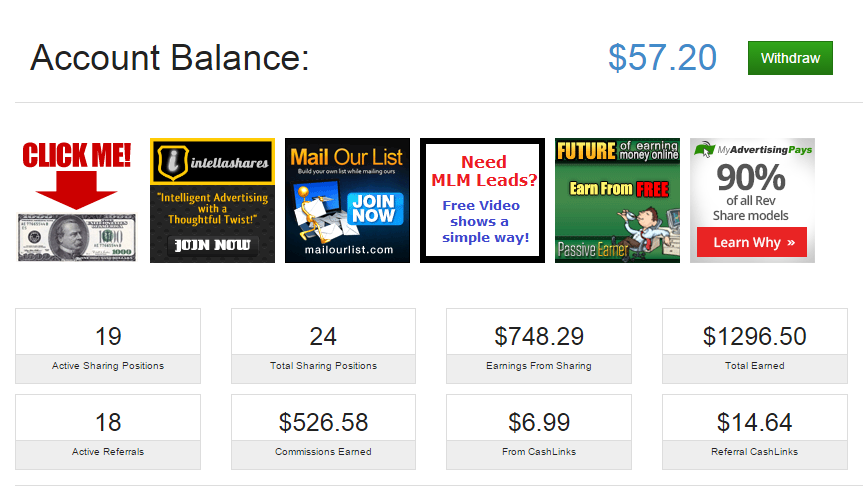

My Advertising Pays

This is a traffic and revenue sharing

program that allows me to get paid every 20 minutes even when no one

joins me. Results not typical.

So from my online businesses mentioned

on this blog, I'm bringing in $160-200 per week. My total income,

cash in hand, is around $410-450 per week. This will double when GI

bill kicks in.

My biggest monthly bill is Child

Support to the tune of $1118 per month. I have a cell phone,

groceries, and etc but that's flexible and minimal.

My weekly groceries are usually Grits

(or oatmeal, farina, etc) with a dozen eggs and every morning will

have one serving of grits with a fried egg on top. Lunch is Peanut

Butter and Jelly or various cold cut sandwiches. Dinner is chicken,

steak, rice, and veggies. My diet is controlled as to maintain

weight and most of all budget.

I don't have a car and rely on public

transportation.

My hobbies are reading (books are cheap

from Amazon), running (a new pair of running shoes every 6 months is

around $30-60), and running my online businesses.

I was never the financial planner type

but more the paycheck to paycheck man and am more than feeling the

effects now. I have heard a quote that I love and that is me.

“Men in the 30's are often making up

for mistakes made in their 20's” Steve Harvey click to tweet

and at 34 am making up for a period of

some bad financial decisions and a divorce. This is the start of my

story and will update this blog daily.

If you are in a situation and you would

like to create some extra cash in your life life then

CLICK HERE to take the first step!

Rob Fraser

P.S. Leave a comment if you have any money saving or money making tips !!!

No comments:

Post a Comment